By Order of the Board of Directors,

F. J. Buri Corporate Secretary |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

Wisconsin Power and Light Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

Reg. (S) 240.14a-101.

SEC 1913 (3-99)

Y O U R V O T E I S I M P O R T A N T

YOUR VOTE IS IMPORTANT

Wisconsin

Power and Light Company

Company

NOTICEOF 20042006 ANNUAL MEETING

PROXY STATEMENTAND

20032005 ANNUAL REPORT

WISCONSIN POWER AND LIGHT COMPANY

ANNUAL MEETING OF SHAREOWNERS

| DATE: | Wednesday, | |

| TIME: |

| |

| LOCATION: | Wisconsin Power and Light Company

4902 North Biltmore Lane Madison, | |

SHAREOWNER INFORMATION NUMBERS

LOCAL | ||

| TOLL FREE | ||

Wisconsin Power and Light Company

4902 North Biltmore Lane

P. O. Box 2568

Madison, WI 53701-2568

Phone: 608.458.3110

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

Dear Wisconsin Power and Light Company Shareowner:

On Wednesday, June 2, 2004,May 24, 2006, Wisconsin Power and Light Company (the “Company”) will hold its 20042006 Annual Meeting of Shareowners at the offices of Alliant Energy Corporation, 4902 North Biltmore Lane, NileMississippi Meeting Room, Madison, Wis. The meeting will begin at 3:2:00 p.m. Central Daylight Time.

Only the sole common shareowner, Alliant Energy Corporation, and preferred shareowners who owned stock at the close of business on April 13, 2004,10, 2006 may vote at this meeting. All shareowners are requested to be present at the meeting in person or by proxy so that a quorum may be ensured. At the meeting, the Company’s shareowners will:will be asked to:

| 1. | Elect |

| 2. | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2006; and |

| Attend to any other business properly presented at the meeting. |

The Board of Directors of the Company presently knows of no other business to come before the meeting.

Please sign and return the enclosed proxy card as soon as possible.

The Company’s 20032005 Annual Report appears as Appendix BA to this proxy statement. The proxy statement and Annual Report have been combined into a single document to improve the effectiveness of our financial communication and to reduce costs, although the Annual Report does not constitute a part of the proxy statement.

Any Wisconsin Power and Light Company preferred shareowner who desires to receive a copy of the Alliant Energy Corporation 20032005 Annual Report, to ShareownersNotice of Annual Meeting and Proxy Statement may do so by calling the Company’s Shareowner Services Department at the Shareowner Information Numbersshareowner information numbers shown at the front of this proxy statement or writing to the Company at the address shown above.

By Order of the Board of Directors,

F. J. Buri Corporate Secretary |

Dated and mailed on or about April 16, 200413, 2006.

1

| 1 | ||

Report of the Compensation and Personnel Committee on Executive Compensation | ||

| 23 | ||

| ||

| 1. Q: | Why am I receiving these materials? |

| A: | The Board of Directors of Wisconsin Power and Light Company (the “Company”) is providing these proxy materials to you in connection with the Company’s Annual Meeting of Shareowners (the “Annual Meeting”), which will take place on Wednesday, |

| 2.Q: | What is Wisconsin Power and Light Company and how does it relate to Alliant Energy Corporation? |

| A: | The Company is a subsidiary of Alliant Energy Corporation (“AEC”), a public utility holding company whose other primary first tier subsidiaries |

| 3. Q: | Who is entitled to vote at the Annual Meeting? |

| A: | Only shareowners of record at the close of business on April |

| 4. Q: | What may I vote on at the Annual Meeting? |

| A: | You may vote on the election of |

| 5. Q: | How does the Board of Directors recommend I vote? |

| A: | The Board of Directors recommends that you vote your shares FOR each of the listed director |

| 6. Q: | How can I vote my shares? |

| A: | You may vote either in person at the Annual Meeting or by appointing a proxy. If you desire to appoint a proxy, then sign and date each proxy card you receive and return it in the envelope provided. Appointing a proxy will not affect your right to vote your shares if you attend the Annual Meeting and desire to vote in person. |

| 7. Q: | How are votes counted? |

| A: | In voting on the election of directors, you may vote FOR all of the director nominees or you may WITHHOLD your vote |

| 8. Q: | Can I change my vote? |

| A: | You have the right to revoke your proxy at any time before the Annual Meeting by: |

Attendance at the Annual Meeting will not cause your previously appointed proxy to be revoked unless you specifically so request in writing.

| 9. Q: | What does it mean if I get more than one proxy card? |

| A: | If your shares are registered differently and are in more than one account, then you will receive more than one proxy card. Be sure to vote all of your accounts to ensure that all of your shares are voted. The Company encourages you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting the Company’s Shareowner Services Department at the |

1

| 10. Q: | Who may attend the Annual Meeting? |

| A: | All shareowners who owned shares of the Company’s common stock and preferred stock on April |

| 11. Q: | How will voting on any other business be conducted? |

| A: | The Board of Directors of the Company does not know of any business to be considered at the Annual Meeting other than the election of |

| 12. Q: | Where and when will I be able to find the results of the voting? |

| A: | The results of the voting will be announced at the Annual Meeting. You may also call the Company’s Shareowner Services Department at the |

| 13. Q: | When are shareowner proposals for the |

| A: | All shareowner proposals to be considered for inclusion in the Company’s proxy statement for the |

| 14. Q: | Who |

| A: | Deloitte & Touche LLP audited the financial statements of the Company for the year ended Dec. 31, |

| 15. Q: | Who will bear the cost of soliciting proxies for the Annual Meeting and how will these proxies be solicited? |

| A: | The Company will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by the Company’s officers and employees who will not receive any additional compensation for these solicitation activities. The Company will pay banks, brokers, nominees and other fiduciaries reasonable charges and expenses incurred in forwarding the proxy materials to their principals. |

| 16. Q. | How can I obtain a copy of the Company’s Annual Report on Form 10-K? |

| A: | The Company will furnish without charge, to each shareowner who is entitled to vote at the Annual Meeting and who makes a written request, a copy of the Company’s Annual Report on Form 10-K (without exhibits) as filed with the SEC. Written requests for the Form 10-K should be mailed to the Corporate Secretary of the Company at the address |

| 17. Q: | If more than one shareowner lives in my household, how can I obtain an extra copy of the Company’s |

| A: | Pursuant to the rules of the SEC, services that deliver the Company’s communications to shareowners that hold their stock through a bank, broker or other holder of record may deliver to multiple shareowners sharing the same address a single copy of the Company’s |

2

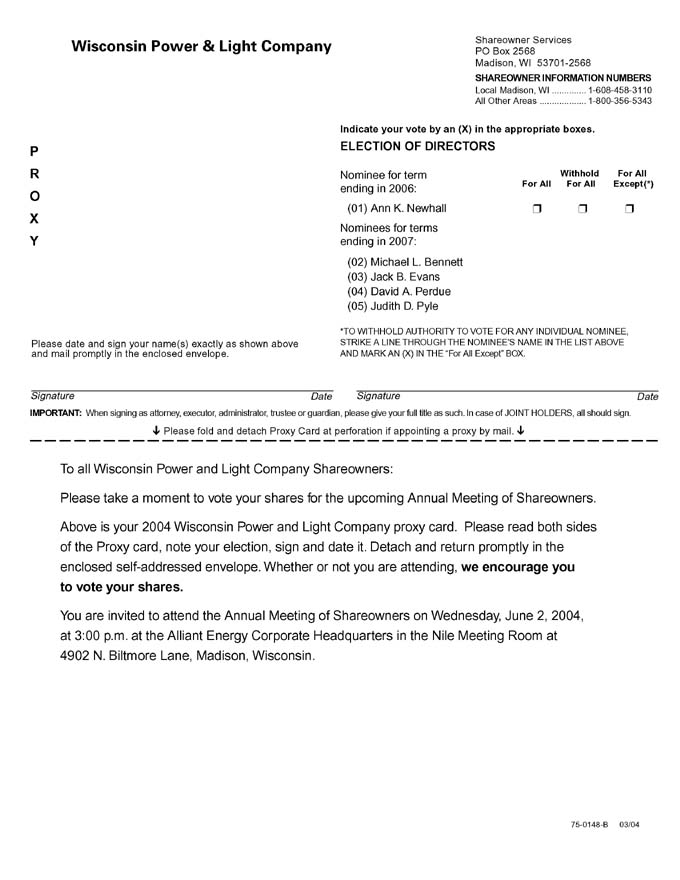

At the Annual Meeting, one director will be elected for a term expiring in 2006 and fourthree directors will be elected for terms expiring in 2007.2009. The nominees for election as recommended by the Nominating and Governance Committee and selected by the Board of Directors are:are Ann K. Newhall, for a term expiring in 2006;Dean C. Oestreich and Michael L. Bennett, Jack B. Evans, David A. Perdue and Judith D. Pyle for terms expiring in 2007.Carol P. Sanders. Each of the nominees is currently serving as a director of the Company. Each person elected as a director will serve until the Annual Meeting of Shareowners of the Company in 2006 or 2007, as the case may be,2009, or until his or her successor has been duly electedqualified and qualified.elected.

Directors will be elected by a plurality of the votes cast at the meeting (assuming a quorum is present). Consequently,any shares not voted at the meeting will have no effect on the election of directors. The proxies solicited may be voted for a substitute nominee or nominees if any of the nominees are unable to serve, or for good reason will not serve, a contingency not now anticipated.

Brief biographies of the director nominees and continuing directors follow. These biographies include their ageages (as of Dec. 31, 2003)2005), an account of their business experience and the names of publicly held and certain other corporations of which they are also directors. Except as otherwise indicated, each nominee and continuing director has been engaged in his or her present occupation for at least the past five years.

NOMINEES

| ANN K. NEWHALL Age 54 | Director Nominated Term expires in 2009 | |||

Ms. Newhall is Executive Vice President, Chief Operating Officer, Secretary and a Director of Rural Cellular Corporation, a cellular communications corporation located in Alexandria, Minn. She has served as Executive Vice President and Chief Operating Officer since August 2000, as Secretary since February 2000 and as a Director since August 1999. Prior to assuming her current positions, she served as Senior Vice President and General Counsel from 1999 to 2000. She was previously a shareholder and President of the Moss & Barnett law firm in Minneapolis, Minn. Ms. Newhall has served as a Director of AEC, IP&L and | |||||

| DEAN C. OESTREICH Age 53 | Director since 2005 Nominated Term expires in 2009 | |||

| Mr. Oestreich has served as President of Pioneer Hi-Bred International, Inc., a developer and supplier of advanced plant genetics, and a wholly-owned subsidiary of DuPont Corporation, located in Johnston, Iowa, since 2004. He previously served as Vice President and Business Director of North America from 2002 to 2004, Vice President and Director of Supply Management from 2001 to 2002 and Vice President and Director for Africa, Middle East, Asia and Pacific from 1999-2001. Mr. Oestreich was appointed a Director of the Company, AEC, IP&L and Resources in July 2005. He was originally recommended as a nominee in | |||||

| CAROL P. SANDERS Age 38 | Director since 2005 Nominated Term expires in 2009 | |||

| Ms. Sanders has served as Chief Financial Officer and Corporate Secretary of Jewelers Mutual Insurance Company of Neenah, Wis., a nationwide insurer that specializes in protecting jewelers and personal jewelry, since 2004. She previously served as Controller and Assistant Treasurer of Sentry Insurance located in Stevens Point, Wis. from 2001 to 2004. From 1999 to 2001, she served as Vice President and Treasurer of American Medical Security, Inc. located in Green Bay, Wis. Ms. Sanders was appointed a Director of the Company, AEC, IP&L and Resources in November 2005. She was originally recommended as a nominee in 2005 by a third-party search firm acting on behalf of the Nominating and Governance Committee. | |||||

The Board of Directors recommends a vote FOR all nominees for election as directors.

3

CONTINUING DIRECTORS

| MICHAEL L. BENNETT Age 52 | Director Term expires in 2007 | |||

Mr. Bennett has served as President and Chief Executive Officer of Terra Industries Inc., an international producer of nitrogen products and methanol ingredients headquartered in Sioux City, Iowa, since April 2001. From 1997 to 2001, he was Executive Vice President and Chief Operating Officer of Terra Industries Inc. He also serves as Chairman of the Board for Terra Nitrogen Corp., a subsidiary of Terra Industries Inc. Mr. Bennett has served as a Director of AEC, IP&L and | |||||

|

Age 56 | Director Term expires in 2008 | ||||

Mr. | ||||||

| SINGLETON B. MCALLISTER Age 53 | Director since 2001 Term expires in 2008 | ||||

| Ms. McAllister has been a | ||||||

| DAVID A. PERDUE Age 56 | Director Term expires in 2007 | ||||

Mr. Perdue is Chairman of the Board and Chief Executive Officer of Dollar General Corporation, a retail | ||||||

| JUDITH D. PYLE Age 62 | Director Term expires in 2007 | ||||

Ms. Pyle is President of Judith Dion Pyle and Associates, a financial services company located in Middleton, Wis. Prior to assuming her current position in 2003, she served as Vice Chair of The Pyle Group, a financial services company located in Madison, Wis. She previously served as Vice | ||||||

The Board of Directors unanimously recommends a vote FOR all nominees for election as directors.

CONTINUING DIRECTORS

|

Age 69 | Director Term expires in 2008 | ||||

| ||||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

Mr. Weiler is Chairman and President of A. R. Weiler Co. LLC, a consulting firm for home furnishings organizations. He was previously a Senior Vice President of Heilig-Meyers Company, a national furniture retailer headquartered in Richmond, Va. He is a Director of the Retail Home Furnishings Foundation. Mr. Weiler has served as a Director of IP&L (or predecessor companies) since 1979 and of AEC and | ||||

4

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors has standing Audit; Compensation and Personnel; Nominating and Governance; Environmental, Nuclear, Health and Safety; NominatingCapital Approval; and Governance; and Capital ApprovalExecutive Committees. The Board of Directors has adopted formal written charters for each of the Audit, Compensation and Personnel, and Nominating and Governance Committees, which are available, free of charge, on the Company’s websiteAEC’s Web site atwww.alliantenergy.com/investors under the “Corporate Governance” caption.caption or in print to any shareowner who requests them from the Company’s Corporate Secretary. The following is a description of each of these committees:committees. Joint meetings in the descriptions below refer to meetings of the committees of the Company, AEC, IP&L and Resources.

Audit Committee

The Audit Committee held sevennine joint (the Company, AEC, IP&L and AER) meetings in 2003.2005. The Committee currently consists of J. B. Evans (Chair), A. B. Arends, M. L. Bennett (Chair), S. B. McAllister, andA. K. Newhall, D. A. Perdue.Perdue and C. P. Sanders. Each of the members of the Committee is independent as defined by the New York Stock Exchange (“NYSE”) listing standards and SEC rules. The Board of Directors has determined that Mr. EvansBennett and two additional Audit Committee members qualify as “audit committee financial experts” as defined by SEC rules. The Audit Committee is responsible for assisting Board oversight of: (1) the integrity of the Company’s financial statements; (2) the Company’s compliance with legal and regulatory requirements; (3) the independent auditors’registered public accounting firm’s qualifications and independence; and (4) the performance of the Company’s internal audit function and the independent auditors.registered public accounting firm. The Audit Committee is also directly responsible for the appointment, retention, termination, compensation and oversight of the Company’s independent auditors.registered public accounting firm.

Compensation and Personnel Committee

The Compensation and Personnel Committee held threefive joint meetings in 2003.2005. The Committee currently consists of J. D. PyleS. B. McAllister (Chair), A. B. Arends, M. L. Bennett, S. B. McAllisterD. C. Oestreich and D. A. Perdue. Each of the members of the Committee is independent as defined by the NYSE listing standards.standards and SEC rules. This Committee reviews and approves corporate goals and objectives relevant to Chief Executive Officer (“CEO”) compensation, evaluates the CEO’s performance and determines and approves as a committee, or together with the other independent directors, the CEO’s compensation level based on the evaluation of the CEO’s performance. In addition, the Committee has responsibilities with respect to the Company’s executive compensation and incentive programs and management development programs.

Environmental, Nuclear, Health and Safety Committee

The Environmental, Nuclear, Health and Safety Committee held two joint meetings in 2003. The Committee currently consists of R. W. Schlutz (Chair), K. C. Lyall, A. K. Newhall, J. D. Pyle and A. R. Weiler. The Committee’s responsibilities are to review environmental policy and planning issues of interest to the Company, including matters involving the Company before environmental regulatory agencies and compliance with air, water and waste regulations. In addition, the Committee reviews policies and operating issues related to the Company’s nuclear generating station investments, including planning and funding for decommissioning of the plants. The Committee also reviews health and safety related policies, activities and operational issues as they affect employees, customers and the general public.

Nominating and Governance Committee

The Nominating and Governance Committee held fourthree joint meetings in 2003.2005. The Committee currently consists of A. R. Weiler (Chair), K. C. Lyall, A. K. Newhall, J. D. Pyle and R. W. Schlutz. Each of the members of the Committee is independent as defined by the NYSE listing standards.standards and SEC rules. This Committee’s responsibilities are to: (1) identify individuals qualified to become Board members, consistent with the criteria approved by the Board, and to recommend nominees for directorships to be filled by the Board or shareowners; (2) identify and recommend Board members qualified to serve on Board committees; (3) develop and recommend to the Board a set of corporate governance principles; (4) oversee the evaluation of the Board and the Company’s management; and (5) advise the Board with respect to other matters relating to corporate governance of the Company.

In making recommendations to the Company’s Board of Directors of nominees to serve as directors, the Nominating and Governance Committee will examine each director nominee on a case-by-case basis regardless of who recommended the nominee and take into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge. However, the Committee believes that, to be recommended as a director nominee, each candidate must:

5

The Committee also believes the following qualities or skills are necessary for one or more directors to possess:

The Nominating and Governance Committee will consider nominees recommended by shareowners in accordance with the Company’s Nominating and Governance Committee Charter and the Corporate Governance Principles.

The Company and the Committee maintain a file of recommended potential director nominees which isreviewed at the time a search for a new director needs to be performed. To assist the Committee in its identification of qualified director candidates, the Committee may engage an outside search firm.

Any shareowner wishing to make a recommendation should write to the Corporate Secretary of the Company and include appropriate biographical information concerning each proposed nominee. The Corporate Secretary will forward all recommendations to the Committee. The Company’s Bylaws also set forth certain requirements for shareowners wishing to nominate director candidates directly for consideration by shareowners. These provisions require such nominations to be made pursuant to timely notice (as specified in the Bylaws) in writing to the Corporate Secretary of the Company.

The Company and the Committee maintain a file of recommended potential director nominees which is reviewed at the time a search for a new director needs to be performed. To assist the Committee in its identification of qualified director candidates, the Committee may engage an outside search firm.

Environmental, Nuclear, Health and Safety Committee

The Environmental, Nuclear, Health and Safety Committee held two joint meetings in 2005. The Committee currently consists of R. W. Schlutz (Chair), J. D. Pyle, D. C. Oestreich, C. P. Sanders and A. R. Weiler. Each of the members of the Committee is independent as defined by the NYSE listing standards and SEC rules. The Committee’s responsibilities are to review environmental policy and planning issues of interest to the Company, including matters involving the Company before environmental regulatory agencies and compliance with air, water and waste regulations. The Committee also reviews health and safety-related policies, activities and operational issues as they affect employees, customers and the general public. In addition, the Committee reviews issues related to nuclear generating facilities from which the Company and IP&L purchase power.

Capital Approval Committee

The Capital Approval Committee held twono meetings in 2003.2005. The Committee currently consists of M. L. Bennett, J. B. EvansD. A. Perdue and A. R. Weiler. Mr. DavisHarvey is the Chair and a non-voting member of this Committee. The purpose of this Committee is to evaluate certain investment proposals where (1) an iterative bidding process is required, and/or (2) the required timelines for such a proposal would not permit the proposal to be brought before a regular meeting of the Board of Directors and/or a special meeting of the full Board of Directors is not practical or merited.

Executive Committee

The Executive Committee held no meetings in 2005. The Committee currently consists of M. L. Bennett, S. B. McAllister, R. W. Schlutz and A. R. Weiler. Mr. Harvey is the Chair and a non-voting member of this Committee. The purpose of this Committee is to possess all the powers and authorities of the Board of Directors when the Board is not in session, except for the powers and authorities set forth in Section 180.0825 (5) (a-h) of the Wisconsin Business Corporation Law.

The Board of Directors held sixseven joint meetings during 2003.2005. Each director attended at least 75% of the aggregate number of meetings of the Board and Board committees on which he or she served.

The Board and each Board committee conduct performance evaluations annually to determine their effectiveness and suggest improvements for consideration and implementation. In addition, the Compensation and Personnel Committee evaluates Mr. Davis’Harvey’s performance as CEO on an annual basis.

Board members are not expected to attend the Company’s Annual Meeting of Shareowners.Meeting. In 2003,2005, none of the Board members were present for the Company’s directors attended the Annual Meeting of Shareowners.Meeting.

6

Corporate Governance Principles

The Board of Directors has adopted Corporate Governance Principles that, in conjunction with the Board committee charters, establish processes and procedures to help ensure effective and responsive governance by the Board. The Corporate Governance Principles are available, free of charge, on the Company’s websiteAEC’s Web site atwww.alliantenergy.com/investors under the “Corporate Governance” caption.caption or in print to any shareowner who requests them from the Company’s Corporate Secretary.

The Board of Directors has adopted certain categorical standards of independence to assist it in making determinations of director independence under the NYSE listing standards. TheseUnder these categorical standards, appear as Appendix the following relationships that currently exist or that have existed, including during the preceding three years, willnot be considered to be material relationships that would impair a director’s independence:

In addition, any relationship that a director (or an “immediate family member” of the director) previously had that constituted an automatic bar to independence under NYSE listing standards will not be considered to be a material relationship that would impair a director’s independence three years after the end of such relationship in accordance with NYSE listing standards.

Based on these standards, the Board of Directors has affirmatively determined by resolution that each of the Company’s directors (other than Mr. Davis,Harvey, the Company’s Chairman and CEO) has no material relationship with the Company and, therefore, is independent in accordance with the NYSE listing standards. The Board of Directors will regularly review the continuing independence of the directors.

The Corporate Governance Principles provide that at least 75% of the members of the Board of Directors must be independent directors under the NYSE listing standards. The Audit, Compensation and Personnel, and Nominating and Governance and Compensation and Personnel Committees must consist of all independent directors.

Lead Independent Director; Executive Sessions

The Corporate Governance Principles provide that the chairperson of the Nominating and Governance Committee shall be the designated “Lead Independent Director” or“Presiding Independent Director” and will preside as the chair at meetings or executive sessions of the independent directors. As the Chairperson of the Nominating and Governance Committee, Mr. Weiler is currently designated

7

as the Lead Independent Director. At every regular jointin-person meeting of the Board of Directors, the independent directors meet in executive session with no member of Company management present.

Communication with Directors

Shareowners and other interested parties may communicate with the full Board, non-management directors as a group or individual directors, including the PresidingLead Independent Director, by providing such communication in writing to the Company’s Corporate Secretary, who will post such communications directly to the Company’s Board of Directors’ website.Web site.

Ethical and Legal Compliance Policy

The Company has adopted a Code of Ethics that applies to all employees, including its CEO, Chief Operating Officer, Chief Financial Officer and Chief Accounting Officer, as well as its Board of Directors. The Company makes its Code of Ethics available, free of charge, on the Company’s website,AEC’s Web site atwww.alliantenergy.com/investors, under the “Corporate Governance” caption and such Code of Ethics is availableor in print to any shareowner who requests it from the Company’s Corporate Secretary. The Company intends to satisfy the disclosure requirements under Item 105.05 of Form 8-K regarding amendments to, or waivers from, the Code of Ethics by posting such information on its websiteWeb site address stated above under the Corporate Governance“Corporate Governance” caption.

No retainer fees are or were paid to Mr. Harvey or Erroll B. Davis, Jr., the Company’s former Chairman and CEO, for histheir service on the Company’s Board of Directors. In 2003,2005, all other directors (the “non-employee directors”), each of whom served on the Boards of the Company, AEC, IP&L and AER,Resources, received an annual retainer for service on all four Boards consisting of $47,137$85,000 in cash. Of thisAlso, in 2005, the Chairperson of the Audit Committee received an additional $10,000 cash amount,retainer and the Chairpersons of the Compensation and Personnel, Nominating and Governance, and Environmental, Nuclear, Health, and Safety Committees received an additional $5,000 cash retainer; other members of the Audit Committee received a $3,500 cash retainer; and the Lead Independent Director received an additional $15,000 cash retainer. Travel expenses incurred by the non-employee directors are paid for each meeting attended.

In 2006, the non-employee directors will each receive a cash retainer of $100,000. In 2006, the Chairperson of the Audit Committee will receive an additional $10,000 cash retainer; the Chairpersons of the Compensation and Personnel, Nominating and Governance, and Environmental, Nuclear, Health, and Safety Committees will each receive an additional $5,000 cash retainer; other members of the Audit Committee will each receive an additional $3,500 cash retainer; and the Lead Independent Director will receive an additional $20,000 cash retainer.

Each non-employee director is encouraged to voluntarily electedelect to use $17,137not less than 50% of his or her cash retainer to purchase 1,000 shares of AEC common stock pursuant to AEC’s Shareowner Direct Plan or to defer such amount through the Company StockAEC stock account in the AEC Director’s Deferred Compensation Plan. Travel expenses are paid for each meeting day attended.

In 2004, the non-employee directors will each receive a cash retainer of $70,000. The Directors are encouraged to make a voluntary election to use not less than 50% of this cash retainer to purchase shares of AEC common stock pursuant to AEC’s Shareowner Direct Plan or to defer through the AEC Stock account in AEC’s Director’s Deferred Compensation Plan. In 2004, the Chairperson of the Audit Committee will receive an additional $7,500 cash retainer and the Chairpersons of the Nominating and Governance; Compensation and Personnel; and Environmental, Nuclear, Health, and Safety Committees will receive an additional $5,000 cash retainer.

Director’s Deferred Compensation Plan

Under the AEC Director’s Deferred Compensation Plan (“DDCP”), directors may elect to defer all or part of their retainer fee. Amounts deposited to a Deferred Compensation Interest Account receive an annual return based on the A-Utility Bond Rate with a minimum return no less than the prime interest rate published inThe Wall Street Journal, provided that the return may not be greater than 12% or less than 6%. Amounts deposited to anthe AEC Stock Account are treated as though invested in the common stock of AEC and will be credited with dividends,dividend equivalents, which will be treated as if reinvested. The director may elect that the AEC Deferred Compensation Account be paid in a lump sum or in annual installments for up to 10 years beginning in the year of or one, two or three tax years after retirement or resignation from the Board.Board of Directors of AEC.

Internal Revenue Code (the “Code”) Section 409A. Code Section 409A imposes restrictions on nonqualified deferred compensation arrangements that do not meet specified criteria as set forth in the statute and supporting guidance. If any of the arrangements provided under the DDCP fail to meet the criteria specified in Code Section 409A, or if the DDCP is not operated by AEC in accordance with such requirements, then a participant will recognize ordinary income at the time of deferral and may be liable for an excise tax on such amounts. AEC anticipates that the DDCP will meet the specified criteria set forth in the statute and the supporting guidance under Code Section 409A.

Director’s Charitable Award Program

AEC maintains a Director’s Charitable Award Program for thecertain members of its Board of Directors beginning after threeyearsthree years of service. The participants in this Program currently are E. B. Davis, S. B. McAllister, D. A. Perdue, J. D. Pyle and A. R. Weiler. K. C. Lyall, who retired as a director on May 19, 2005, is also a participant in the Program. The purpose of the

8

Program is to recognize the interest of the Company and its directors in supporting worthy institutions and to enhance the Company’s director benefit program so that the Company is able to continue to attract and retain directors of the highest caliber.institutions. Under the Program, when a director dies, the Company and/or AEC will donate a total of $500,000 to one qualified charitable organization or divide that amount among a maximum of five qualified charitable organizations selected by the individual director. The individual director derives no financial benefit from the Program. All deductions for charitable contributions are taken by the Company and/or AEC, and the donations are funded by the Company or AEC through life insurance policies on the directors. Over the life of the Program, all costs of donations and premiums on the life insurance policies, including a return of the Company’s or AEC’s cost of funds, will be recovered through life insurance proceeds on the directors. The Program, over its life, will not result in any material cost to the Company or AEC. The Board of Directors of AEC has terminated this Program for all new directors who join the Board after Jan. 1, 2005.

Director’s Life Insurance Program

AEC maintains a split-dollar Director’s Life Insurance Program for non-employee directors, beginning after three years of service, whichdirectors. The participants in this Program currently include J. D. Pyle and A. R. Weiler. K. C. Lyall, who retired as a director on May 19, 2005, is also a participant in the Program. The Program provides a maximum death benefit of $500,000 to each eligible director. Under the split-dollar arrangement, directors are provided a death benefit only and do not have any interest in the cash value of the policies. The Life Insurance Program is structured to pay a portion of the total death benefit to AEC to reimburse AEC for all costs of the program,Program, including a return on its funds. The Life Insurance Program, over its life, will not result in any material cost to AEC. The imputed income allocations reported for each director in 20032005 under the Director’s Life Insurancethis Program were as follows: A. B. Arends—$50, J. B. Evans—$2, K. C. Lyall—$488,Lyall — $566, J. D. Pyle—$24, W. H. Stoppelmoor—$987Pyle — $29, and A. R. Weiler—$50.

Weiler — $50. In November of 2003, the Board of Directors of AEC terminated this insurance benefit for any director not already having the required vesting period of three years of service and for all new directors.

OWNERSHIP OF VOTING SECURITIES

All of the common stock of the Company is held by AEC. None of the directors or officers of the Company own any shares of the Company’s preferred stock. Listed in the following table are the number of shares of AEC’s common stock beneficially owned by (1) the executive officers listed in the Summary Compensation Table, (2) all director nominees and directors of the Company, and(3)and (3) all director nominees, directors and executive officers as a group as of Feb. 27, 2004.28, 2006. The directors and executive officers of AEC and the Company as a group owned 1.4%1% of the outstanding shares of AEC common stock on that date. No individual director or officer owned more than 1% of the outstanding shares of AEC common stock on that date.

NAME OF BENEFICIAL OWNER | SHARES BENEFICIALLY

| ||

| |||

| (3) | ||

Erroll B. Davis, Jr. | 971,906 | (3)(4) | |

Eliot G. Protsch | (3) | ||

Barbara J. Swan | (3) | ||

| |||

| |||

Director Nominees | |||

Ann K. Newhall | (3) | ||

| (3) | ||

| (3) | ||

Directors | |||

Michael L. Bennett | 5,357 | (3) | |

William D. Harvey | 316,297 | (3) | |

Singleton B. McAllister | 7,911 | (3) | |

David A. Perdue | (3) | ||

Judith D. Pyle | |||

| 14,612 | |||

| (3) | ||

| |||

| |||

| |||

| |||

| |||

Anthony R. Weiler | (3) | ||

All | |||

| (3) | ||

| (1) | Total shares of AEC common stock outstanding as of Feb. |

9

| (2) | Stock ownership of Mr. |

| (3) | Included in the beneficially owned shares shown are indirect ownership interests with shared voting and investment powers: Mr. |

| (4) |

| (5) | Mr. |

To the Company’s knowledge, no shareowner beneficially owned 5% or more of any class of the Company’s preferred stock as of Dec. 31, 2003.2005. The following table sets forth information, as of Dec. 31, 2003,2005, regarding beneficial ownership by the only personpersons known to AEC to own morethanmore than 5% of AEC’s common stock. The beneficial ownership set forth below has been reported on a Schedule 13G filings with the Securities and Exchange CommissionSEC by the beneficial owner.owners.

| Amount and Nature of Beneficial Ownership | |||||||||||||

| Voting Power | Investment Power | Aggregate | Percent of Class | ||||||||||

Name and Address of Beneficial Owner | Sole | Shared | Sole | Shared | |||||||||

Franklin Resources, Inc. (and certain affiliates) | 6,451,800 | 0 | 6,451,800 | 0 | 6,451,800 | 5.8 | % | ||||||

Amount and Nature of Beneficial Ownership

| Voting Power | Investment Power | |||||||||||

Name and Address of Beneficial Owner | Sole | Shared | Sole | Shared | Aggregate | Percent of Class | ||||||

Barclays Global Investors, N. A. (and certain affiliates) 45 Fremont Street San Francisco, CA 94105

| 8,088,178 | 0 | 8,980,537 | 0 | 8,980,537 | 7.68% | ||||||

Franklin Resources, Inc. (and certain affiliates) One Franklin Parkway San Mateo, CA 94403-1906

| 7,422,770 | 0 | 7,424,370 | 0 | 7,424,370 | 6.40% | ||||||

10

COMPENSATION OF EXECUTIVE OFFICERS

The following Summary Compensation Table sets forth the total compensation paid by the Company, AEC and AEC’s other subsidiaries to the Chief Executive Officer and certain other executive officers of the Company for all services rendered during 2003, 20022005, 2004 and 2001.2003.

SUMMARY COMPENSATION TABLE

| Annual Compensation | Long-Term Compensation |

| ||||||||||||||||||||||

|

| |||||||||||||||||||||||

| Awards(4) | Payouts | |||||||||||||||||||||||

|

| |||||||||||||||||||||||

| Base Salary | Bonus | Other Annual Compensation(3) | Restricted Stock Awards(5) | Securities Underlying Options (Shares) | LTIP Payouts(6) | All Other Compensation(7) | ||||||||||||||||||

Erroll B. Davis, Jr.

| $ | 749,019 685,000 | $ | 0 | $ | $ | 300,453 0 | 0 151,687 | $ | $ | 168,040 138,719 45,253 | |||||||||||||

William D. Harvey(2) Chairman and Chief | | | 0 | | | 100,143 0 | 0 26,642 | | ||||||||||||||||

| | |||||||||||||||||||||||

Eliot G. Protsch Chief Financial Officer | | 106,000 142,167 0 | 5,960 6,014 4,825 | 693,504 149,981 0 | 0 40,996 26,642 | 590,961 0 0 | 62,468 43,611 15,605 | |||||||||||||||||

Barbara J. Swan President | 2005 2004 2003 | 312,694 298,674 265,000 | 73,000 110,791 0 | 5,627 5,255 0 | 124,933 100,143 0 | 0 32,026 24,705 | 537,224 0 0 | 23,875 18,843 14,536 | ||||||||||||||||

Thomas L. Aller Senior Vice President | 2005 2004 2003 | 244,265 237,692 200,000 | 49,000 123,203 189,170 | | 0 0 | | | 0 | | |||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| (1) |

| (2) | Mr. Harvey was Chief Operating Officer from Jan. 1, 2005 until July 1, 2005 and has served as CEO since July 1, 2005. On Feb. 7, 2006, Mr. Harvey was also elected Chairman. |

| (3) | Other Annual Compensation consists of income tax gross-ups for split-dollar life insurance and, for Mr. Davis only, air travel. Certain personal benefits provided by the Company or AEC to the executive officers named in the Summary Compensation Table above are not included in the Summary Compensation Table. The aggregate amount of such personal benefits for each such executive officer in each year reflected in the Summary Compensation Table did not exceed the lesser of $50,000 or 10% of the sum of such executive officer’s base salary and bonus in each respective year. |

| (4) | Awards made in |

The amounts in the Summary Compensation Table above for restricted stock granted in 2004 and 2005 represent the market value based on the closing price of AEC common stock on the date of the grants. Mr. Protsch was granted 2,008 shares of restricted stock on Jan. 3, 2004 that vested on Jan. 3, 2006. All other shares of restricted stock granted to the executive officers listed in 2004 were granted on Jan. 30, 2004 and vest three years after the date of grant. Mr. Harvey was granted 34,880 shares of restricted stock on July 11, 2005 that vest 20% on the third anniversary of the grant date, 40% on the fourth anniversary of the grant date and 40% on the fifth anniversary of the grant date. Mr. Protsch was granted 17,440 shares of restricted stock on July 11, 2005 that vest 20% on the third anniversary of the grant date, 30% on the fourth anniversary of the grant date and 50% on the fifth anniversary of the grant date. All other shares of restricted stock granted to the executive officers listed in 2005 vest subject to meeting certain performance criteria. The shares vest if for the second, third or fourth year of the performance period, AEC’s annual Earnings Per Average Common Share from Continuing Operations (“EPS”) is at least 116% of EPS for the year ending immediately prior to the beginning of the performance period. More specifically, the performance contingency is satisfied if on Dec. 31, |

11

2006, 2007 or 2008 AEC’s EPS is at least 116% of the EPS for the year ending 2004. As of Dec. 31, 2005, the total number of shares of restricted common stock (and their market value based on the closing price of AEC common stock on Dec. 30, 2005, the last trading day of the year) held by each executive officer listed in the Summary Compensation Table above were as follows: Mr. Davis, 33,623 shares ($942,789); Mr. Harvey, 49,122 shares ($1,377,381); Mr. Protsch, 30,109 shares ($844,256); Ms. Swan, 8,314 shares ($233,125); and Mr. Aller, 2,594 shares ($72,736). Holders of restricted stock are entitled to receive all dividends on such shares of restricted stock prior to vesting. Such dividends are reinvested into AEC common stock and are subject to the same vesting schedule as the restricted stock on which they are earned. |

| (6) |

| The table below shows the components of the compensation reflected under this column for |

| Erroll B. Davis, Jr. | William D. Harvey | Barbara J. Swan | Eliot G. Protsch | Pamela J. Wegner | Thomas M. Walker | ||||||||||||||||||||||||||||

| Erroll B. Davis, Jr. | William D. Harvey | Eliot G. Protsch | Barbara J. Swan | Thomas L. Aller | |||||||||||||||||||||||||||||

| A. | $ | 20,550 | $ | 6,000 | $ | 6,000 | $ | 7,450 | $ | 7,375 | $ | 6,000 | $ | 23,271 | $ | 9,923 | $ | 9,064 | $ | 6,300 | $ | 6,300 | |||||||||||

| B. | 19,656 | 8,497 | 7,576 | 7,104 | 10,393 | 19,830 | 99,652 | 36,316 | 28,902 | 7,398 | 0 | ||||||||||||||||||||||

| C. | 5,047 | 1,065 | 960 | 1,051 | 1,873 | 1,839 | 8,808 | 4,205 | 1,560 | 1,156 | 1,634 | ||||||||||||||||||||||

D. | 36,309 | 33,729 | 22,942 | 9,021 | 2,763 | ||||||||||||||||||||||||||||

| Total | $ | 45,253 | $ | 15,562 | $ | 14,536 | $ | 15,605 | $ | 19,641 | $ | 27,669 | $ | 168,040 | $ | 84,173 | $ | 62,468 | $ | 23,875 | $ | 10,697 | |||||||||||

| A. | Matching contributions to |

| B. |

| C. | Life insurance coverage in excess of $50,000 |

| D. | Dividends earned in 2005 on restricted stock |

The following table sets forth certain information concerningAEC did not grant any stock options to purchase shares of AEC common stock granted during 2003 to the executives named below:in 2005.

STOCK OPTION GRANTS IN 2003

Name | Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) | ||||||||||||||

Number of Underlying Options | % of Total Options Granted to Employees in Fiscal Year | Exercise ($/Share) | Expiration Date | 5% | 10% | |||||||||||

Erroll B. Davis, Jr. | 151,687 | 15.8 | % | $ | 16.82 | 1/21/13 | $ | 1,604,848 | $ | 4,066,728 | ||||||

William D. Harvey | 26,642 | 2.8 | % | 16.82 | 1/21/13 | 281,872 | 714,272 | |||||||||

Barbara J. Swan | 24,705 | 2.6 | % | 16.82 | 1/21/13 | 261,379 | 662,341 | |||||||||

Eliot G. Protsch | 26,642 | 2.8 | % | 16.82 | 1/21/13 | 281,272 | 714,272 | |||||||||

Pamela J. Wegner | 25,673 | 2.7 | % | 16.82 | 1/21/13 | 271,620 | 688,293 | |||||||||

Thomas M. Walker(3) | 25,673 | 2.7 | % | 16.82 | 11/15/03 | 0 | 0 | |||||||||

The following table provides information for the executives named below regarding options exercised in 2005 and the number and value of exercisable and unexercisedunexercisable options. None of the executives exercised options in fiscal 2003.

AGGREGATE OPTION EXERCISES IN 2005 AND OPTION VALUES AT DEC. 31, 20032005

Shares on Exercise | Value ($) | Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised In-the-Money Options at Year End(1) | ||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised In-the-Money Options at Year End(1) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||||||||||||

Erroll B. Davis, Jr. | 388,778 | 289,009 | $ | 0 | $ | 1,225,631 | |||||||||||||||||||

Erroll B. Davis, Jr.(2) | 0 | $ | 0 | 667,564 | 157,442 | $ | 1,335,742 | $ | 893,706 | ||||||||||||||||

William D. Harvey | 87,403 | 51,669 | 0 | 215,267 | 0 | 0 | 149,975 | 57,851 | 275,089 | 237,949 | |||||||||||||||

Eliot G. Protsch | 0 | 0 | 139,156 | 36,212 | 245,449 | 178,668 | |||||||||||||||||||

Barbara J. Swan | 71,426 | 47,912 | 0 | 199,616 | 0 | 0 | 110,644 | 29,585 | 130,857 | 156,959 | |||||||||||||||

Eliot G. Protsch | 87,403 | 51,669 | 0 | 215,267 | |||||||||||||||||||||

Pamela J. Wegner | 73,859 | 49,790 | 0 | 207,438 | |||||||||||||||||||||

Thomas M. Walker | 0 | 0 | 0 | 0 | |||||||||||||||||||||

Thomas L. Aller | 0 | 0 | 86,135 | 20,249 | 156,466 | 108,568 | |||||||||||||||||||

| (1) | Based on the closing per share price of |

| (2) | Pursuant to the terms of his stock option award agreements, all of Mr. Davis’ unvested stock options vested immediately upon his retirement on Feb. 1, 2006, and he has three years from such date to exercise his vested stock options. |

12

The following table provides information concerning long-term incentive awards made to the executives named below in 2003.2005.

LONG-TERM INCENTIVE AWARDS IN 20032005

| Name | Number of Shares, Units or Other Rights (#)(1) | Performance or Other Period Until Maturation or Payout | Estimated Future Payouts Under Non-Stock Price-Based Plans | Number of Shares, Units or Other Rights (#)(1) | Performance or Other Period Until Maturation or Payout | Estimated Future Payouts Under Non-Stock Price-Based Plans | ||||||||||||||

| Threshold (#) | Target (#) | Maximum (#) | ||||||||||||||||||

Threshold (#) | Target (#) | Maximum (#) | ||||||||||||||||||

Erroll B. Davis, Jr. | 57,135 | 1/01/06 | 28,568 | 57,135 | 114,270 | |||||||||||||||

Erroll B. Davis, Jr.(2) | 33,027 | 1/1/2008 | 16,514 | 33,027 | 66,054 | |||||||||||||||

William D. Harvey | 12,108 | 1/01/06 | 6,054 | 12,108 | 24,216 | 15,561 | 1/1/2008 | 7,781 | 15,561 | 31,122 | ||||||||||

Eliot G. Protsch | 9,509 | 1/1/2008 | 4,755 | 9,509 | 19,018 | |||||||||||||||

Barbara J. Swan | 11,007 | 1/01/06 | 5,504 | 11,007 | 22,014 | 6,669 | 1/1/2008 | 3,335 | 6,669 | 13,338 | ||||||||||

Eliot G. Protsch | 12,108 | 1/01/06 | 6,054 | 12,108 | 24,216 | |||||||||||||||

Pamela J. Wegner | 11,416 | 1/01/06 | 5,708 | 11,416 | 22,832 | |||||||||||||||

Thomas M. Walker(2) | 12,263 | N/A | N/A | N/A | N/A | |||||||||||||||

Thomas L. Aller | 3,458 | 1/1/2008 | 1,729 | 3,458 | 6,916 | |||||||||||||||

| (1) | Consists of performance shares awarded |

| (2) | Pursuant to the terms of his |

Mr. Davis currently hasDavis’ position as Chairman of the Board was subject to an employment agreement with AEC, pursuant to which he willwould serve as the Chairman of AEC until the expiration of the term of the agreement on the date of AEC’s 2006 annual meeting of shareowners,Annual Meeting, but no later than May 30, 2006. In addition, he willwas to serve as the Chief Executive Officer of AEC during the term of the agreement unless otherwise determined by the Board of Directors. Under the employment agreement, Mr. Davis willwould also serve as the Chief Executive Officer of the Company, IP&L and each subsidiary of AEC, including the Company,Resources as long as he holdsheld the same position for AEC. On July 1, 2005, AEC’s Board of Directors appointed Mr. Harvey as the Chief Executive Officer and President of AEC and the Company’s Board of Directors appointed Mr. Harvey as the Chief Executive Officer of the Company. Mr. Davis remained Chairman of the Board of AEC, the Company, IP&L and Resources. Pursuant to the employment agreement, Mr. Davis will bewas paid an annual base salary of not less than $750,000. Mr. Davis also will haveretired and resigned from his position as Chairman of the Board effective Feb. 1, 2006. Under the employment agreement, Mr. Davis was afforded the opportunity to earn short-term and long-term incentive compensation (including stock options, restricted stock and other long-term incentive compensation) at least equal to other executive officers and receive supplemental retirement benefits (including continued participation in the AECAlliant Energy Corporation Executive Tenure Compensation Plan) and life insurance providing a death benefit of three times his annual salary. ForIn conjunction with Mr. Davis’ retirement, for purposes of AEC’s Supplemental Executive Retirement Plan described in detail under “Retirement and Employee Benefit Plans,” (i) Mr. Davis will be deemed to have been paid an annual bonus for 2003 of $595,539 (the amount that he would have received had he been eligible for such a bonus for such year); (ii) if Mr. Davis ceases, no bonus for 2005, and a pro-rata bonus of $104,000 for 2006, which has been deemed to be the Chief Executive Officer while remaining the Chairman in 2005 and if the annual bonus for 2005 payable in 2006 is less than theestimated target award for Mr. Davis for 2005, Mr. Davis will be deemed to have earned the target award; (iii) aaward. A special calculation will apply to protect the dollar amount that Mr. Davis could have been paid on May 1, 2003 if he had retired on April 30, 2003; and (iv) upon termination of employment2003. Mr. Davis generally will be deemed to be a retiree not subject to the early commencement reduction factors that would otherwise apply. For purposes of AEC’s Executive Tenure Compensation Plan, the Board of Directors has determined to treat Mr. Davis as an eligible retiree at his futurethe termination of his employment, regardless of the circumstances other than death. If, prior to the end of the term of the agreement, the employmentThe voluntary retirement of Mr. Davis is terminated by AEC without cause (as defined in the employment agreement), or if Mr. Davis terminates his employment for good reason (as defined in the employment agreement), or if the employment of Mr. Davis is terminated aswas considered a result of the mutual agreement of Mr. Davis and the Board of Directors, AEC or its affiliates will continue to provide the compensation and benefits called for by the employment agreement through the later of theend of the term of the agreement or one year after such termination of employment (with incentive compensation based on the maximum potential awards and with any stock compensation paid in cash), and all unvested stock compensation will vest immediately. If Mr. Davis dies or terminates his employment without good reason prior to the end of the term of the agreement,employment agreement. Therefore, AEC or its affiliates will pay topaid Mr. Davis or his beneficiaries or estate all compensation earned through the date of death or such terminationFeb. 1, 2006 (including previously deferred compensation

13

and pro rata short-term incentive compensation of $104,000 based upon the maximum potential awards)award). If Mr. Davis’ employment is terminated by reason of his disability, he will be entitled to such benefits as may be provided by AEC’s current disability program. If Mr. Davis is terminated for cause, AEC or its affiliates will pay his base salary through the date of termination plus any previously deferred compensation. In any such case, Mr. Davis shall also be eligible for the benefits he has accrued under the applicable retirement plans, including the benefits under the Supplemental Executive Retirement Plan and the Executive Tenure Compensation Plan. Under the employment agreement, if any payments thereunder constitute an excess parachute payment under the Code, then AEC will pay to Mr. Davis the amount necessary to offset the excise tax and any applicable taxes on this additional payment.

AEC currently has in effect key executive employment and severance agreements (the “KEESAs”) with certainits executive officers and certain key employees of AEC (including Messrs. Davis, Harvey, and Protsch and Mses. SwanAller and Wegner)Ms. Swan). The KEESAs provide that each executive officer who is a party thereto is entitled to benefits if, within a period of up to three years (depending on which executive is involved) after a change in control of AEC (as defined in the KEESAs) (the “Employment Period”), the officer’s employment is ended through (a) termination by AEC, other than by reason of death or disability or for cause (as defined in the KEESAs); or (b) termination by the officer due to a breach of the agreement by AEC or a significant change in the officer’s responsibilities; or (c) in the case of Mr. Davis’ agreement, termination by Mr. Davis following the first anniversary of the change of control. Theresponsibilities.The benefits provided are (a) a cash termination payment of up to three times (depending on which executive is involved) the sum of the officer’s annual salary and his or her average annual bonus during the three years before the termination; and (b) continuation for up to the end of the Employment Period of equivalent hospital, medical, dental, accident and

life insurance coverage as in effect at the time of termination. Each KEESA for executive officers below the level of Executive Vice President of AEC provides that if any portion of the benefits under the KEESA or under any other agreement for the officer would constitute an excess parachute payment for purposes of the Code, benefits will be reduced so that the officer will be entitled to receive $1 less than the maximum amount which he or she could receive without becoming subject to the 20% excise tax imposed by the Code on certain excess parachute payments, or which AEC may pay without loss of deduction under the Code. The KEESAs for the Chairman, Chief Executive Officer, President, Senior Executive Vice President, and the Executive Vice Presidents of AECPresident and Senior Vice President (including Messrs. Davis, Harvey, and Protsch and Mses. SwanAller and Wegner)Ms. Swan) provide that if any payments thereunder or otherwise constitute an excess parachute payment, AEC will pay to the appropriate officer the amount necessary to offset the excise tax and any additional taxes on this additional payment. Mr. Davis’ employment agreement as described above limits benefits paid thereunder to the extent that duplicate payments would be provided to him under his KEESA.KEESA terminated on Feb. 1, 2006.

AEC entered into a Severance Agreement and Release with Mr. Walker in connection with the conclusion of his employment with AEC as of November 15, 2003. AEC (a) paid Mr. Walker $680,000, (b) paid $10,000 towards his legal fees associated with the agreement and (c) agreed to provide him with up to $20,000 for either outplacement services or tuition reimbursement. Mr. Walker ceased to be eligible to participate under any of AEC’s stock option, bonus, equity, incentive compensation, non-qualified supplemental retirement plan, medical, dental, life insurance, retirement, pension and other compensation or benefit plans upon his termination of employment, except that he retained vested rights under AEC’s qualified retirement plans and his rights under AEC’s Key Employee Deferred Compensation Plan, and he is eligible for COBRA continuation for his medical and dental plans. If Mr. Walker elects COBRA continuation, AEC will pay for this coverage for up to 18 months. Under the agreement, Mr. Walker agreed to a two-year covenant not to compete and agreed to keep Company information confidential. In connection with the agreement, Mr. Walker provided AEC and its affiliates, including the Company, a general liability release.14

RETIREMENT AND EMPLOYEE BENEFIT PLANS

Alliant Energy Cash Balance Pension Plan

Salaried employees (including officers) of the Company are eligible to participate in the Alliant Energy Cash Balance Pension Plan (the “Pension Plan”) maintained by Alliant Energy Corporate Services. The Pension Plan bases a participant’s defined benefit pension on the value of a hypothetical account balance. For individuals participating in the Pension Plan as of Aug. 1, 1998, a starting account balance was created equal to the present value of the benefit accrued as of Dec. 31, 1997, under the applicable prior benefit formula. In addition, such individuals received a special one-time transition credit amount equal to a specified percentage varying with age multiplied by credited service and pay. For 1998 and thereafter, a participant receives annual credits to the account equal to 5% of base pay (including certain incentive payments, pre-tax deferrals and other items), plus an interest credit on all prior accruals equal to 4%, plus a potential share of the gain on the investment return on assets in the trust investment for the year.

The life annuity payable under the Pension Plan is determined by converting the hypothetical account balance credits into annuity form. Individuals who were participants in the Pension Plan on Aug. 1, 1998, are in no event to receive any less than what would have been provided under the prior formula that was applicable to them, had it continued, if they terminate on or beforeAug.before Aug. 1, 2008, and do not elect to commence benefits before the age of 55.

All of the individuals listed in the Summary Compensation Table participate in the Pension Plan and are “grandfathered” under the applicable prior plan benefit formula. Because their estimated benefits under the applicable prior plan benefit formula are expected to be higher than under the Pension Plan formula, utilizing current assumptions, their benefits would currently be determined by the applicable prior plan benefit formula. At the time of his resignation from the Company in November 2003, Mr. Walker had a vested balance of $68,056 in the Pension Plan. The following table illustrates the estimated annual benefits payable upon retirement at age 65 under the applicable prior plan formula based on average annual compensation and years of service. To the extent benefits under the Pension Plan are limited by tax law, any excess will be paid under the Unfunded Excess Plan described below.

Company Plan A Prior Formula.

One of the applicable prior plan formulas provided retirement income based on years of credited service and final average compensation for the 36 highest consecutive months, with a reduction for Social Security offset. The individuals listed in the Summary Compensation Table covered by this formula are Messrs. Davis, Harvey and Protsch and HarveyMs. Swan. The following table illustrates the estimated annual benefits payable upon retirement at age 65 under the prior plan formula based on average annual compensation and Mses. Swan and Wegner.years of service. The benefits would be as follows:

Company Plan A Prior Plan Formula Table

Average Annual Compensation | Annual Benefit After Specified Years in Plan | Annual Benefit After Specified Years in Plan | ||||||||||||||||||||||

| 15 | 20 | 25 | 30+ | 15 | 20 | 25 | 30+ | |||||||||||||||||

| $ 200,000 | $ | 55,000 | $ | 73,333 | $ | 91,667 | $ | 110,000 | $ | 55,000 | $ | 73,333 | $ | 91,667 | $ | 110,000 | ||||||||

| 300,000 | 82,500 | 110,000 | 137,500 | 165,000 | 82,500 | 110,000 | 137,500 | 165,000 | ||||||||||||||||

| 400,000 | 110,000 | 146,667 | 183,333 | 220,000 | 110,000 | 146,667 | 183,333 | 220,000 | ||||||||||||||||

| 500,000 | 137,500 | 183,333 | 229,167 | 275,000 | 137,500 | 183,333 | 229,167 | 275,000 | ||||||||||||||||

| 600,000 | 165,000 | 220,000 | 275,000 | 330,000 | 165,000 | 220,000 | 275,000 | 330,000 | ||||||||||||||||

| 700,000 | 192,500 | 256,667 | 320,833 | 385,000 | 192,500 | 256,667 | 320,833 | 385,000 | ||||||||||||||||

| 800,000 | 220,000 | 293,333 | 366,667 | 440,000 | 220,000 | 293,333 | 366,667 | 440,000 | ||||||||||||||||

| 900,000 | 247,500 | 330,000 | 412,500 | 495,000 | 247,500 | 330,000 | 412,500 | 495,000 | ||||||||||||||||

| 1,000,000 | 275,000 | 366,667 | 458,333 | 550,000 | 275,000 | 366,667 | 458,333 | 550,000 | ||||||||||||||||

| 1,100,000 | 302,500 | 403,333 | 504,167 | 605,000 | 302,500 | 403,333 | 504,167 | 605,000 | ||||||||||||||||

For purposes of the Pension Plan, compensation means payment for services rendered, including vacation and sick pay, and is substantially equivalent to the salary amounts reported in the Summary Compensation Table. PensionPlanPension Plan benefits depend upon length of Pension Plan service (up to a maximum of 30 years), age at retirement and amount of compensation (determined in accordance with the Pension Plan) and are reduced by up to 50% of Social

Security benefits. The estimated benefits in the table above do not reflect the Social Security offset. The estimated benefits are computed on a straight-life annuity basis. Benefits will be adjusted if the employee receives one of the optional forms of payment. Credited years of service under the Pension Plan for covered persons named in the Summary Compensation Table are as follows: Erroll B. Davis, Jr., 2426 years; William D. Harvey, 18 years; Eliot G. Protsch, 2426 years; William D. Harvey, 16 years;and Barbara J. Swan, 15 years;17 years.

IES Industries Pension Plan Prior Formula. The other applicable prior plan formula provided retirement income based on years of service and Pamela J. Wegner, 9 years.final average compensation. Mr. Aller has a frozen benefit of $7,608 annually under this prior formula which is payable at age 65.

15

Unfunded Excess Plan

Alliant Energy Corporate Services maintains an Unfunded Excess Plan that provides funds for payment of retirement benefits above the limitations on payments from qualified pension plans in those cases where an employee’s retirement benefits exceed the qualified plan limits. The Unfunded Excess Plan provides an amount equal to the difference between the actual pension benefit payable under the Pension Plan and what such pension benefit would be if calculated without regard to any limitation imposed by the Code on pension benefits or covered compensation. Upon Mr. Davis’ retirement on Feb. 1, 2006, his vested benefit had a lump sum value of $3,003,018. A portion of Mr. Davis’ benefit was paid on Feb. 1, 2006, and the remaining balance is payable on Aug. 1, 2006.

Unfunded Executive Tenure Compensation Plan

Alliant Energy Corporate Services maintains an Unfunded Executive Tenure Compensation Plan to provide incentive for selected key executives to remain in the service of AEC by providing additional compensation that is payable only if the executive remains with AEC until retirement (or other termination if approved by the Board of Directors)Directors of AEC). Any participant in the Plan must be approved by the Board of Directors. Mr. Davis was the only active participant in the Plan as of Dec. 31, 2003.2005. The Plan provides for monthly payments to a participant after retirement (at or after age 65, or with AEC Board approval, prior to age 65) for 120 months. The payments will be equal to 25% of the participant’s highest average salary for any consecutive 36-month period. If a participant dies prior to retirement or before 120 payments have been made, the participant’s beneficiary will receive monthly payments equal to 50% of such amount for 120 months in the case of death before retirement or, if the participant dies after retirement, 50% of such amount for the balance of the 120 months. Annual benefits of $171,250 would be$184,620 are payable to Mr. Davis upon retirement, assuming he continues in the service of AlliantEnergy Corporate Services until retirement at the same salary as was in effectcommencing on Dec. 31, 2003.Sept. 1, 2006.

Supplemental Executive Retirement Plan

AEC maintains an unfunded Supplemental Executive Retirement Plan (“SERP”) to provide incentive for key executives to remain in the service of the CompanyAEC by providing additional compensation that is payable only if the executive remains with AEC until retirement, disability or death. While the SERP provides different levels of benefits depending on the executive covered, this summary reflects the terms applicable to all of the individuals listed in the Summary Compensation Table. Participants in the SERP must be approved by the Compensation and Personnel Committee of the Board. The

For Messrs. Davis, Harvey and Protsch, and Ms. Swan, the SERP provides for payments of 60% of the participant’s average annual earnings (base salary and bonus) for the highest paid three years out of the last 10 years of the participant’s employment reduced by the sum of benefits payable to the officer from the officer’s defined benefit plan and the Unfunded Excess Plan. The normal retirement date under the SERP is age 62 with at least 10 years of service and early retirement is at age 55 with at least ten10 years of service. If a participant retires prior to age 62, the 60% payment under the SERP is reduced by 3% per year for each year the participant’s retirement date precedes his/her normal retirement date. The actuarial reduction factor will be waived for participants who have attained age 55 and have a minimum of 10 years of service in a senior executive position with AEC after April 21, 1998. At the timely election of the participant, benefits under the SERP will be made in a lump sum, in installments over a period of up to 10 years, or for the lifetime of the participant. If the lifetime benefit is selected and the participant dies prior to receiving 12 years of payments, payments continue to any surviving spouse or dependent children of a deceased participant who dies while still employed by the Company,AEC, payable for a maximum of 12 years. A post-retirement death benefit of one times the participant’s final average earnings at the time of retirement will be paid to the designated beneficiary. Messrs. Davis, Harvey and Protsch and Mses. Swan and Wegner are participants in the SERP. The following table shows the amount of retirement payments under the SERP, assuming a minimum of 10 years of service at retirement age and payment in the annuity form.

Supplemental Executive Retirement Plan Table

Average Annual Compensation | Annual Benefit After Specified Years in Plan | Annual Benefit After Specified Years in Plan | ||||||||

| < 10 Years | >10 Years* | <10 Years | >10 Years* | |||||||

| $ 200,000 | 0 | $ | 120,000 | 0 | $ | 120,000 | ||||

| 300,000 | 0 | 180,000 | 0 | 180,000 | ||||||

| 400,000 | 0 | 240,000 | 0 | 240,000 | ||||||

| 500,000 | 0 | 300,000 | 0 | 300,000 | ||||||

| 600,000 | 0 | 360,000 | 0 | 360,000 | ||||||

| 700,000 | 0 | 420,000 | 0 | 420,000 | ||||||

| 800,000 | 0 | 480,000 | 0 | 480,000 | ||||||

| 900,000 | 0 | 540,000 | 0 | 540,000 | ||||||

| 1,000,000 | 0 | 600,000 | 0 | 600,000 | ||||||

| 1,100,000 | 0 | 660,000 | 0 | 660,000 | ||||||

* Reduced by the sum of the benefit payable from the applicable defined benefit pension plan and the Unfunded Excess Plan.

16

Upon Mr. Davis’ retirement on Feb. 1, 2006, his benefit had a lump sum value of $5,517,280, payable on January 1, 2007.

For Mr. Aller, the SERP provides for payments of 50% of the participant’s average annual earnings (base salary and bonus) for the highest paid three years out of the last 10 years of the participant’s employment reduced by the sum of benefits payable to the officer from the officer’s defined benefit plan and the Unfunded Excess Plan. The normal retirement date under the SERP is age 62 with at least 10 years of service and early retirement is at age 55 with at least 10 years of service and five or more years of continuous SERP employment. If a participant retires prior to age 62, the 50% payment under the SERP is reduced by 5% per year for each year the participant’s retirement date precedes his/her normal retirement date. At the timely election of the participant, benefits under the SERP will be made in a lump sum, in annual installments over a period of up to 10 years, or in monthly installments for 18 years. If the monthly installment option is selected and the participant dies prior to receiving 12 years of payments, payments continue to any surviving spouse or dependent children of a deceased participant who dies while still employed by AEC, payable for a maximum of 12 years. The following table shows the amount of retirement payments under the SERP, assuming a minimum of 10 years of service at retirement age and payment in the annuity form.

Supplemental Executive Retirement Plan Table

Average Annual Compensation | Annual Benefit After Specified Years in Plan | ||||

| <10 Years | >10 Years* | ||||

$ 200,000 | 0 | $ | 100,000 | ||

300,000 | 0 | 150,000 | |||

400,000 | 0 | 200,000 | |||

500,000 | 0 | 250,000 | |||

600,000 | 0 | 300,000 | |||

700,000 | 0 | 350,000 | |||

800,000 | 0 | 400,000 | |||

900,000 | 0 | 450,000 | |||

1,000,000 | 0 | 500,000 | |||

1,100,000 | 0 | 550,000 | |||

* Reduced by the sum of the benefit payable from the applicable defined benefit pension plan and the Unfunded Excess Plan.

Key Employee Deferred Compensation Plan

AEC maintains an unfundeda Key Employee Deferred Compensation Plan (“KEDCP”) under which participants may defer up to 100% of base salary and incentive compensation and eligible SERP payments.compensation. Participants who have made the maximum allowed contribution to the AEC-sponsored 401(k) Savings Plan may receive an additional credit to the Deferred Compensation Plan.KEDCP. The credit will be equal to 50% of the lesser of (a) the amount contributed to the 401(k) Savings Plan plus the amount deferred under this Plan;the KEDCP; or (b) 6% of base salary, reduced by the amount of any matching contributions in the 401(k) Savings Plan. The employee may elect to have his or her deferrals credited to an Interest Account or an AECa Company Stock Account. Deferrals and matching contributions to the Interest Account receivean annual return based on the A-Utility Bond Rate with a minimum return no less than the prime interest rate published inThe Wall Street Journal, provided that the return may not be greater than 12% or less than 6%. Deferrals and matching contributions credited to the AEC Stock Account are treated as though invested in AECthe common stock of AEC and will be credited with dividends,dividend equivalents, which will be treated as if reinvested. The shares of common stock identified as obligations under the PlanKEDCP are held in a rabbi trust. Payments from the PlanKEDCP may be made in a lump sum or in annual installments for up to 10 years at the election of the participant. Participants are selected by the Chief Executive Officer of Alliant Energy Corporate Services. Messrs. Davis, Harvey, and Protsch and Mses.Aller, and Ms. Swan and Wegner are participants in the Plan.KEDCP. Prior to his retirement, Mr. Davis was a participant in the KEDCP and he will receive distributions from the KEDCP in accordance with his prior elections.

17

REPORT OF THE COMPENSATION AND PERSONNEL

COMMITTEE ON EXECUTIVE COMPENSATION

To Our Shareowners:

The Compensation and Personnel Committee (the “Committee”) of the Board of Directors of the Company is currently comprisedcomposed of fivefour independent directors (the same directors that comprise the AEC Compensation and Personnel Committee). The following is a report prepared by these directors with respect to compensation paid by AEC, the Company and AEC’s other subsidiaries.

The Committee assesses the effectiveness and competitiveness of, approves the design of and administers executive compensation programs within a consistent total compensation framework for the Company. The Committee also reviews and approves all salary arrangements and other remuneration for executives,executive officers, evaluates executive officer performance, and considers related matters. It also makes recommendations to the Nominating and Governance Committee regarding Director compensation. To support it in carrying out its mission, the Committee engages an independent consultant (which is retained by the Committee rather than Company executives) to provide assistance.

The Committee is committed to implementing an overall compensation program for executivesexecutive officers that furthers the Company’s mission.strategic plan. Therefore, the Committee adheres to the following compensation policies, which are intended to facilitate the achievement of the Company’s business strategies:

Components of Compensation

The major elements of AEC’s executive compensation program are base salary, short-term (annual) incentives, and long-term (equity) incentives.incentives and other benefits. These elements are addressed separately below. In setting the level for each major component of compensation, the Committee considers all elements of an executive’sexecutive officer’s total compensation package, including employee benefit and perquisite programs. The Committee’s goal is to provide an overall compensation package for each executive officer that is competitive to the packages offered otherto similarly situated executives. Theexecutive officers at companies of similar size. For 2005, the Committee has determined that total executive compensation at target levels including that for Mr. Davis, iswere in line with competitive compensation rates at comparable companies.

To ensure the Committee has adequate time to consider executive officers’ total compensation for the coming year, Committee members are provided detailed compensation information in advance of comparative companies.the second to last Committee meeting of the previous year, which is then presented and analyzed at that Committee meeting. Committee members then have time between meetings to raise questions and ask for additional information. The Committee then makes final decisions regarding compensation at the last Committee meeting of the previous year.

Base Salaries

The Committee annually reviews each executive’sexecutive officer’s base salary. Base salaries are targeted at a competitive market range (i.e., at the median level) when comparing both utility and non-utility (general industry) data from similarly-sized companies, with utility-specific positions based exclusively on energy industry data. The industry peer group the Committee used in 2005 for assessing compensation includes, but is somewhat broader than, the industry index used in the cumulative total shareowner return graph in this proxy statement. The Committee annually adjusts base salaries to recognize changes in

18

the market, AEC performance, varying levels of responsibility, and the executive officers’ prior experience and breadth of knowledge. Increases to base salaries are driven primarily by market adjustments for a particular salary level, which generally limits across-the-board increases. Theincreases, although the Committee also considers individual performance factors in setting base salaries. The Committee reviewed executive salaries for market comparability using utility and general industry data contained in compensation surveys published by the Edison Electric Institute, the American Gas Association and several compensation consulting firms.

In consideration of industry conditionsBased on this data and Company performance,consultation with the independent executive compensation consultant, the Committee did not increaseapproved base salary increases for the base salaries of the Chief Executive Officer and the Executive Vice PresidentsCompany’s executive officers in 2003.

Short-Term Incentives